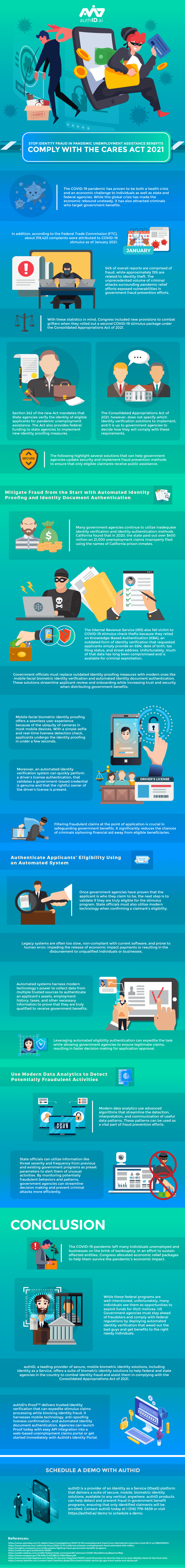

The COVID-19 pandemic has proven to be both a health crisis and an economic challenge to individuals as well as state and federal agencies. While this global crisis has made the economic rebound unsteady, it has also attracted criminals who target government benefits.

Following the passage of the March 2020 Coronavirus Aid, Relief, and Economic Security Act (CARES Act), many US state agencies were overwhelmed with a surge in unemployment benefits enrollment. Unfortunately, agencies also saw a corresponding surge of fraud that, according to USA Today, lost over 36 billion dollars to criminals filing fraudulent unemployment claims under the names of other people.

In addition, according to the Federal Trade Commission (FTC), about 319,423 complaints were attributed to COVID-19 stimulus as of January 2021. 54% of overall reports are comprised of fraud, while approximately 15% are related to identity theft. The unprecedented volume of criminal attacks surrounding pandemic relief efforts exposed vulnerabilities in government fraud prevention efforts.

With these statistics in mind, Congress included new provisions to combat grifters when they rolled out a second COVID-19 stimulus package under the Consolidated Appropriations Act of 2021. Section 242 of the new Act mandates that State agencies verify the identity of eligible applicants for pandemic unemployment assistance. The Act also provides federal funding to state agencies to implement new identity proofing measures.

The Consolidated Appropriations Act of 2021, however, does not specify which identity verification solutions to implement, and it is up to government agencies to decide how they will comply with these requirements. The following highlight several solutions that can help government agencies update security and implement fraud prevention methods to ensure that only eligible claimants receive public assistance.

Mitigate Fraud from the Start with Automated Identity Proofing and Identity Document Authentication

Many government agencies continue to utilize inadequate identity verification and identity authentication methods. California found that in 2020, the state paid out over $400 million on 21,000 unemployment claims improperly filed using the names of California prison inmates. The Internal Revenue Service (IRS) also fell victim to COVID-19 stimulus check thefts because they relied on Knowledge-Based Authentication (KBA), an outdated form of identity verification that requested applicants simply provide an SSN, date of birth, tax filing status, and street address. Unfortunately, much of that data has long been compromised and is available for criminal exploitation.

Government officials must replace outdated identity proofing measures with modern ones like mobile facial biometric identity verification and automated identity document authentication. These solutions streamline applicant review and onboarding while increasing trust and security when distributing government benefits.

Mobile facial biometric identity proofing offers a seamless user experience because of the ubiquity of cameras in most mobile devices. With a simple selfie and real-time liveness detection check, applicants undergo the identity proofing in under a few seconds.

Moreover, an automated identity verification system can quickly perform a driver’s license authentication, that validates a government-issued credential is genuine and that the rightful owner of the driver’s license is present.

Filtering fraudulent claims at the point of application is crucial in safeguarding government benefits. It significantly reduces the chances of criminals siphoning financial aid away from eligible beneficiaries.

Authenticate Applicants’ Eligibility Using an Automated System

Once government agencies have proven that the applicant is who they claim to be, the next step is to validate if they are truly eligible for the stimulus program. State officials must also utilize modern technology when confirming a claimant’s eligibility.

Legacy systems are often too slow, non-compliant with current software, and prone to human error; impeding the release of economic impact payments or resulting in the disbursement to unqualified individuals or businesses.

Automated systems harness modern technology’s power to collect data from multiple trusted sources to authenticate an applicant’s assets, employment history, taxes, and other necessary information to prove that they are truly qualified to receive government benefits.

Leveraging automated eligibility authentication can expedite the task while allowing government agencies to ensure legitimate claims, resulting in faster decision making for application approval.

Use Modern Data Analytics to Detect Potentially Fraudulent Activities

Modern data analytics use advanced algorithms that streamline the detection, interpretation, and communication of useful data patterns. These patterns can be used as a vital part of fraud prevention efforts.

State officials can utilize information like threat severity and frequency from previous and existing government programs as preset parameters to alert them of unusual activities. By monitoring potentially fraudulent behaviors and patterns, government agencies can streamline decision making and prevent criminal attacks more efficiently.

Conclusion

The COVID-19 pandemic left many individuals unemployed and businesses on the brink of bankruptcy. In an effort to sustain affected entities, Congress allocated economic relief packages to help them survive the pandemic’s economic impact.

While these federal programs are well-intentioned, unfortunately, many individuals see them as opportunities to exploit funds for illicit motives. US Government agencies must stay ahead of fraudsters and comply with federal regulations by deploying automated identity verification that weed out the bad guys and get benefits to the right needy individuals.

authID, a leading provider of secure, mobile biometric identity solutions, including Identity as a Service, offers a suite of biometric identity solutions to help federal and state agencies in the country to combat identity fraud and assist them in complying with the Consolidated Appropriations Act of 2021.

authID‘s Proof™ delivers trusted identity verification that can expedite stimulus claims processing while blocking identity fraud. It harnesses mobile technology, anti-spoofing liveness confirmation, and automated identity document authentication. Agencies can launch Proof today with easy API integration into a web-based unemployment claims portal or get started immediately with authID’s Identity Portal.

Schedule a Demo with authID

authID.ai is a provider of an Identity as a Service (IDaaS) platform that delivers a suite of secure, mobile, biometric identity solutions, available to any vertical, anywhere. authID’s products can help detect and prevent fraud in government benefit programs, ensuring that only identified claimants will be enrolled. Contact authID today at 1 (516) 778-5639 or click here to schedule a demo.