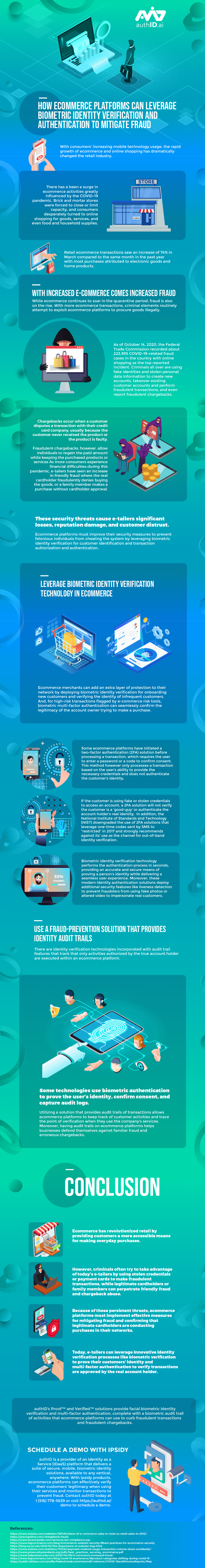

With consumers’ increasing mobile technology usage, the rapid growth of ecommerce and online shopping has dramatically changed the retail industry.

There has a been a surge in ecommerce activities greatly influenced by the COVID-19 pandemic. Brick and mortar stores were forced to close or limit capacity, and consumers desperately turned to online shopping for goods, services, and even food and household supplies.

Retail ecommerce transactions saw an increase of 74% in March compared to the same month in the past year with most purchases attributed to electronic goods and home products.

With Increased E-Commerce Comes Increased Fraud

While ecommerce continues to soar in the quarantine period, fraud is also on the rise. With more ecommerce transactions, criminal elements routinely attempt to exploit ecommerce platforms to procure goods illegally.

As of October 14, 2020, the Federal Trade Commission recorded about 223,995 COVID-19-related fraud cases in the country with online shopping as the top reported incident.

Criminals all over are using fake identities and stolen personal data information to create new accounts, takeover existing customer accounts and perform fraudulent transactions, and even report fraudulent chargebacks.

Chargebacks occur when a customer disputes a transaction with their credit card company, usually because the customer never received the product or the product is faulty. Fraudulent chargebacks, however, allow individuals to regain the paid amount while keeping the purchased products or services As more consumers experience financial difficulties during this pandemic, e-tailers have seen an increase in friendly fraud where the real cardholder fraudulently denies buying the goods, or a family member makes a purchase without cardholder approval.

These security threats cause e-tailers significant losses, reputation damage, and customer distrust.

Ecommerce platforms must improve their security measures to prevent felonious individuals from cheating the system by leveraging biometric identity verification for customer identification and transaction authorization and authentication.

Leverage Biometric Identity Verification Technology in Ecommerce

Ecommerce merchants can add an extra layer of protection to their network by deploying biometric identity verification for onboarding new customers and verifying the identity of infrequent customers. And, for high-risk transactions flagged by e-commerce risk tools, biometric multi-factor authentication can seamlessly confirm the legitimacy of the account owner trying to make a purchase.

Some ecommerce platforms have initiated a two-factor authentication (2FA) solution before processing a transaction, which requires the user to enter a password or a code to confirm consent. This method however only processes a transaction based on the user’s ability to provide the necessary credentials and does not authenticate the customer’s identity. If the customer is using fake or stolen credentials to access an account, a 2FA solution will not verify the customer is a ‘good-guy’ or authenticate the account holder’s real identity. In addition, the National Institute of Standards and Technology (NIST) downgraded the use of 2FA solutions that leverage one-time codes sent by SMS to “restricted” in 2017 and strongly recommends against its’ use as the channel for out-of-band identity verification.

Biometric identity verification technology performs the authentication process in seconds, providing an accurate and secure means of proving a person’s identity while delivering a seamless user experience. Moreover, these modern identity authentication solutions deploy additional security features like liveness detection to prevent fraudsters from using fake photos or altered video to impersonate real customers.

Use a Fraud-Prevention Solution that Provides Identity Audit Trails

There are identity verification technologies incorporated with audit trail features that track that only activities authorized by the true account holder are executed within an ecommerce platform.

Some technologies use biometric authentication to prove the user’s identity, confirm consent, and capture audit logs.

Utilizing a solution that provides audit trails of transactions allows ecommerce platforms to keep track of customer activities and trace the point of verification when they use the company’s services.

Moreover, having audit trails on ecommerce platforms helps businesses defend themselves against familiar fraud and erroneous chargebacks.

Conclusion

Ecommerce has revolutionized retail by providing customers a more accessible means for making everyday purchases.

However, criminals often try to take advantage of today’s e-tailers by using stolen credentials or payment cards to make fraudulent transactions, while legitimate cardholders or family members can perpetrate friendly fraud and chargeback abuse.

Because of these persistent threats, ecommerce platforms must implement effective measures for mitigating fraud and confirming that legitimate cardholders are conducting purchases in their networks.

Today, e-tailers can leverage innovative identity verification processes like biometric verification to prove their customers’ identity and multi-factor authentication to verify transactions are approved by the real account holder.

authID’s Proof™ and Verified™ solutions provide facial biometric identity verification and multi-factor authentication, complete with a biometric audit trail of activities that ecommerce platforms can use to curb fraudulent transactions and fraudulent chargebacks.

Schedule a Demo with authID

authID.ai is a provider of an Identity as a Service (IDaaS) platform that delivers a suite of secure, mobile, biometric identity solutions, available to any vertical, anywhere. With authID’s products, ecommerce platforms can effectively verify their customers’ legitimacy when using their services and monitor transactions to prevent fraud. Contact authID today at 1 (516) 778-5639 or click here to schedule a demo.

References:

https://www.investopedia.com/terms/p/pci-compliance.asp

https://www.bigcommerce.com/blog/ecommerce-website-security/#best-practices-for-ecommerce-security

https://blog.sucuri.net/2019/02/the-importance-of-website-logs.html

https://www.statista.com/statistics/1111233/payment-method-usage-transaction-volume-share-worldwide/

https://www.pcisecuritystandards.org/pdfs/best_practices_securing_ecommerce.pdf

https://www.helpnetsecurity.com/2020/04/09/e-commerce-increased-fraud/

https://www.bigcommerce.com/blog/covid-19-ecommerce/#product-categories-shifting-during-covid-19

https://public.tableau.com/profile/federal.trade.commission#!/vizhome/COVID-19andStimulusReports/Map