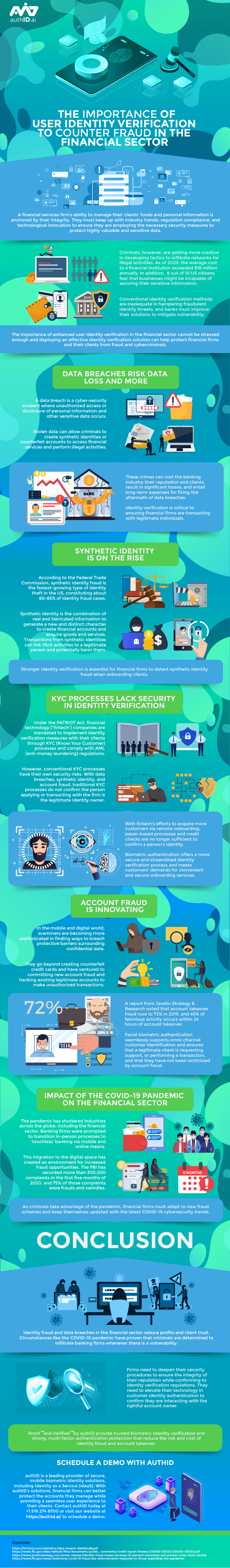

The Importance of Trusted User Identity Verification to Counter Fraud in the Financial Sector

A financial services firm’s ability to manage their clients’ funds and personal information is anchored by their integrity. They must keep up with industry trends, regulation compliance, and technological innovation to ensure they are employing the necessary security measures to protect highly valuable and sensitive data.

Criminals, however, are getting more creative in developing tactics to infiltrate networks for illegal activities. As of 2020, the average cost to a financial institution exceeded $18 million annually. In addition, 8 out of 10 US citizens fear that businesses might be incapable of securing their sensitive information.

Conventional identity verification methods are inadequate in hampering fraudulent identity threats, and banks must improve their solutions to mitigate vulnerability.

The importance of enhanced user identity verification in the financial sector cannot be stressed enough and deploying an effective identity verification solution can help protect financial firms and their clients from fraud and cybercriminals.

Data Breaches Risk Data Loss and More

A data breach is a cyber-security incident where unauthorized access or disclosure of personal information and other sensitive data occurs.

Stolen data can allow criminals to create synthetic identities or counterfeit accounts to access financial services and perform illegal activities.

These crimes can cost the banking industry their reputation and clients, result in significant losses, and entail long-term expenses for fixing the aftermath of data breaches.

Identity verification is critical to ensuring financial firms are transacting with legitimate individuals.

Synthetic Identity is on the Rise

According to the Federal Trade Commission, synthetic identity fraud is the fastest-growing type of identity theft in the US, constituting about 80-85% of identity fraud cases.

Synthetic identity is the combination of real and fabricated information to generate a new and distinct character to create financial accounts and acquire goods and services. Transactions from synthetic identities can link illicit activities to a legitimate person and potentially harm them.

Stronger identity verification is essential for financial firms to detect synthetic identity fraud when onboarding clients.

KYC Processes Lack Security in Identity Verification

Under the PATRIOT Act, financial technology (“fintech”) companies are mandated to implement identity verification measures with their clients through KYC (Know Your Customer) processes and comply with AML (anti-money laundering) regulations.

However, conventional KYC processes have their own security risks. With data breaches, synthetic identity, and account fraud, traditional KYC processes do not confirm the person applying or transacting with the firm is the legitimate identity owner.

With fintech’s efforts to acquire more customers via remote onboarding, paper-based processes and credit checks are no longer sufficient to confirm a person’s identity.

Biometric authentication offers a more secure and streamlined identity verification process and meets customers’ demands for convenient and secure onboarding services.

Account Fraud is Innovating

In the mobile and digital world, scammers are becoming more sophisticated in finding ways to breach protective barriers surrounding confidential data. They go beyond creating counterfeit credit cards and have ventured to committing new account fraud and hacking existing legitimate accounts to make unauthorized transactions.

A report from Javelin Strategy & Research noted that account takeover fraud rose to 72% in 2019, and 40% of felonious activity occurs within 24 hours of account takeover.

Facial biometric authentication seamlessly supports omni-channel customer identification and ensures that a legitimate client is requesting support, or performing a transaction, and that they have not been victimized by account fraud.

.

Impact of the COVID-19 Pandemic on the Financial Sector

The pandemic has shuttered industries across the globe, including the financial sector. Banking firms were prompted to transition in-person processes to ‘touchless’ banking via mobile and online means.

This migration to the digital space has created an environment for increased fraud opportunities. The FBI has recorded more than 300,000 complaints in the first five months of 2020, and 75% of those complaints were frauds and swindles.

As criminals take advantage of the pandemic, financial firms must adapt to new fraud schemes and keep themselves updated with the latest COVID-19 cybersecurity trends.

Conclusion

Identity fraud and data breaches in the financial sector reduce profits and client trust. Circumstances like the COVID-19 pandemic have proven that criminals are determined to infiltrate banking firms whenever there is a vulnerability.

Firms need to deepen their security procedures to ensure the integrity of their reputation while conforming to identity verification regulations. They need to elevate their technology in customer identity authentication to confirm they are interacting with the rightful account owner.

Proof TM and VerifiedTM by authID provide trusted biometric identity verification and strong, multi-factor authentication protection that reduce the risk and cost of identity fraud and account takeover.

Schedule a Demo with authID

authID.ai is a leading provider of secure, mobile biometric identity solutions, including Identity as a Service (IdaaS). With authID’s solutions, financial firms can better protect the accounts they manage while providing a seamless user experience to their clients. Contact authID today at +1 516 274 8700 or click here to schedule a demo.